Corporate Governance Report

Corporate Governance

Report

Basic Policies

Our basic policy to corporate governance is to strive to increase shareholder profits by establishing an appropriate

basic frameworks for corporate management (management oversight, risk management, compliance, accountability, and

management efficiency) in relation to various stakeholders, including shareholders, customers, employees, business

partners, and local communities.

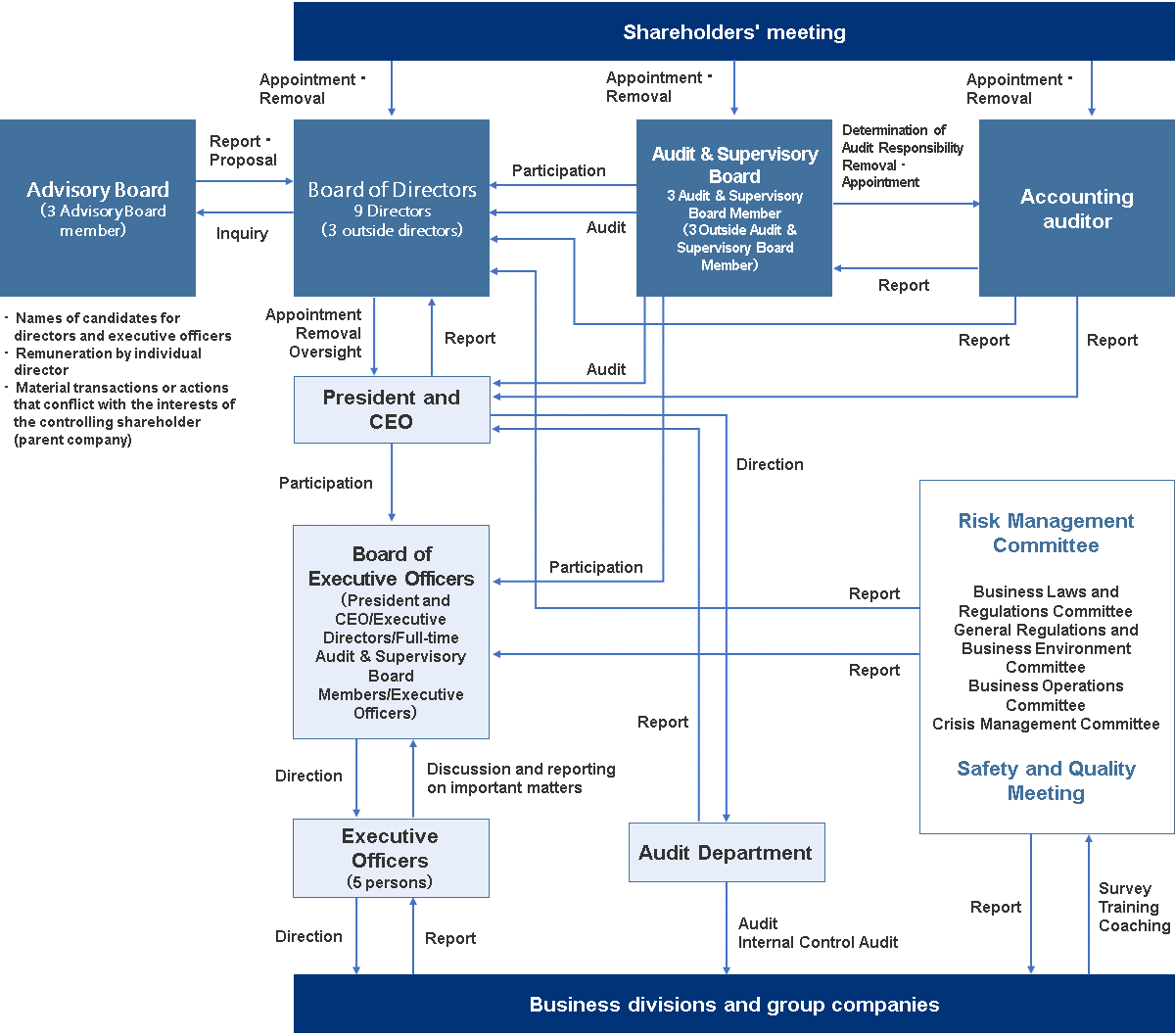

Corporate Governance Structure

As of October 1, 2025

Board of Directors

As of the date of submission, the Company has eight directors, three of whom are outside directors.

Audit & Supervisory Board

Two of the three corporate Audit & Supervisory Board Member are outside corporate Audit & Supervisory Board Member,

and they conduct audits based on the annual audit plan of the corporate auditors.

Optional Organizations

Advisory Board

At its meeting held on August 5, 2021, the Board of Directors resolved to establish an Advisory Board as a optional

organization of the Board of Directors.The Advisory Board, with the aim of improving the self-purification,

autonomy, and transparency of governance at the Company, will make recommendations to the Board of Directors, as

appropriate, after consulting on the nomination of directors and executive officers, individual director

compensation, and important transactions or actions that may cause conflicts of interest with the controlling

shareholder (parent company).The Advisory Board consists of three members selected by the Board of Directors

(Independent Outside Director (Chairman), Outside Audit & Supervisory Board Member, and the President).

Executive Officer System

Our Company has introduced an executive officer system to separate the execution and supervision of business

operations, accelerate management decision-making, and clarify responsibility for business execution.

Board of Directors

Activities in the fiscal year ending June 30, 2024

Effectiveness Assessment

Our company conducts an annual evaluation of the effectiveness of the Board of Directors beginning in the fiscal year

ending June 30, 2019.

For the fiscal year ending June 30, 2024, our Board of Directors prepared a questionnaire on the effectiveness of the

Board of Directors based on the advice of a third-party organization, and the third-party organization collected and

analyzed the questionnaires from the Board members and exchanged opinions with each other at the Board of Directors.

As a result, we evaluated that the effectiveness of the Board of Directors is ensured, as we were able to confirm

that the Board of Directors plays an effective role in improving corporate value over the medium to long term

through active and open discussions at the Board meetings, backed by a well-balanced composition of the Board of

Directors.

On /the other hand, to further improve effectiveness, the results call for further discussion from a medium- to

long-term perspective, the development of a system to promote constructive dialogue with shareholders and investors

to enhance IR activities, and the further enhancement of director training.

In preparing and collecting the survey forms and conducting some of the analysis, we will utilize an outside

organization to increase the transparency of the evaluation and ensure its effectiveness.In preparing and

collecting the survey forms and conducting some of the analysis, we will utilize an outside organization to increase

the transparency of the evaluation and ensure its effectiveness.

Reasons for Appointment

Director

As of October 1, 2024

Audit & Supervisory Board Member

As of October 1, 2024

Skill Matrix

Training

While we recognize that our company's board of directors and Audit & Supervisory Board Member are equipped with

sufficient knowledge, we will provide training and learning opportunities as needed, and will cover the costs of

such training and learning upon request.

Remuneration for board of director

Basic Policy on Determination of Remuneration

Our basic policy for the compensation of directors is to incorporate a compensation system that is linked to

shareholder interests in order to fully function as an incentive to sustainably increase corporate value, and in

determining the compensation of individual directors, our basic policy is to set an appropriate level based on the

responsibilities of each position through a combination of fixed compensation and performance-linked compensation.

In light of their responsibilities, outside board of directors who are responsible for the supervisory function

shall be paid only the basic remuneration.

Procedures for Determining Remuneration

In determining the remuneration of Board of Directors, the Board of Directors shall delegate the responsibility to

the President and CEO subject to resolution at a meeting of the Board of Directors to be held after the annual

general meeting of shareholders for each fiscal year, in order to make decisions in line with the evaluation of each

Board of Director, while taking into consideration the performance of the entire Group and other relevant factors.

The reason for delegation is that we has determined that the President and CEO is best suited to evaluate the

divisions for which each board of director is responsible while taking into consideration the overall performance of

our company.When making a decision on the delegated content, we shall consult with the Advisory Board on the

appropriateness of the content, etc. in advance and shall respect the report of the Advisory Board.The Advisory

Board consists of three members selected by the board of directors, two of whom are outside directors, and is

chaired by an independent outside director.

Remuneration for corporate Audit & Supervisory Board Member will be determined by discussion among the Audit &

Supervisory Board Member within the total amount of remuneration determined by resolution of the general meeting of

shareholders.

Total amount of remuneration for board of directors and Audit & Supervisory Board Member

(FY2023)

Independence Criteria for Outside Board of director and Outside Audit & Supervisory Board Member

In order to ensure the objectivity and transparency necessary for the proper governance of our company, we will

establish independence criteria for candidates for o Outside Board of director and Outside Audit & Supervisory Board

Member, and if none of the following items applies, the candidate will be deemed to have sufficient independence for

our company.

Independent Director Notification Form(Available in Japanese Only)

1.A person who falls under any of the items defined below (hereinafter referred to as “Conflicts”) at the present

time or in the past three years

2.A spouse, a relative within the second degree of kinship, or a relative living in the same household as the

applicant who currently falls under any of Conflicts.

3.Notwithstanding the provisions of any of the foregoing paragraphs, any other person who is deemed to have a

special reason that could cause a conflict of interest with our company.

Conflicts

- ① Executive directors, executive officers, and other similar persons and employees of our company and our

consolidated subsidiaries (hereinafter referred to as “our group”) (hereinafter referred to as “executive

officers”)

- ② Our group's major business partners or their executive officers (Note)

- ③ Lawyers, certified public accountants, tax accountants, consultants, or other professionals who receive more

than ¥10 million per year in cash or other assets from our company group, other than remuneration for directors

and corporate auditors.

- ④ If (iii) is an organization such as a corporation, partnership, etc., the criteria specified in (ii) shall

apply.

- ⑤ Persons or entities that receive donations or grants of more than 10 million yen per year from our group or

belong to organizations such as corporations

- ⑥ In the event that an executive director or full-time Audit & Supervisory Board Member of our company group

concurrently serves as an outside board of director or outside Audit & Supervisory Board Member of another

company, the executive director or full-time s Audit & Supervisory Board Member of that other company

- ⑦ A person who directly or indirectly holds 10% or more of the total voting rights of our company or a person

who executes the business of such a person

- ⑧ A person in which our company directly or indirectly holds 10% or more of the total voting rights, or a person

who executes the business of such a person

- ⑨ A partner of our company's accounting auditor or a person engaged in the audit of our company

Note: Our group's major business partners are defined as follows.

* Suppliers of our group's goods or services whose annual transaction value exceeds 2% of our company's consolidated

net sales on average for the past three fiscal years.

* Our company's suppliers of goods or services whose annual transaction value exceeds 2% of the other party's

consolidated net sales on average over the past three fiscal years.

* Our group's borrowers whose outstanding loans exceed 2% of our company's consolidated total assets as of the end

of our fiscal year